Pay-As-You-Go: Mobilizing credit in western Africa

The mainstay of Germany’s initiative for Green People’s Energy for Africa is to improve proliferation of decentralized energy access and supply in rural regions. One of the main hurdles to widespread adoption of stand-alone renewable energy systems is, simply put, the financing. Upfront investments to getting renewable energy access off the ground pose a key challenge. Credits are hard to come by, require considerable administrative effort, are costly to manage, come with high risk of defaults and are rarely competitive due to high interest rates.

As Green People’s Energy (GBE) is exploring in western Africa, mobile payments based on the pay-as-you-go model show potential for opening the market for renewable energy products and services as well as substantially improving business and living conditions of people living in rural areas.

As the International Renewable Energy Agency (IRENA) reported in 2020 on pay-as-you-go (PAYG) models, while the costs of renewable energy can help communities access clean electricity without grid extensions, “making the upfront investments necessary to set up distributed renewable energy systems […] remains a difficult undertaking in many areas, particularly rural communities.” Further, many in rural Africa still do not have a bank account to take up loans or credits. Smallholder farmers, in particular, are excluded from opportunities for improving productivity with technology using renewable energy.

PAYG for renewables in agribusiness

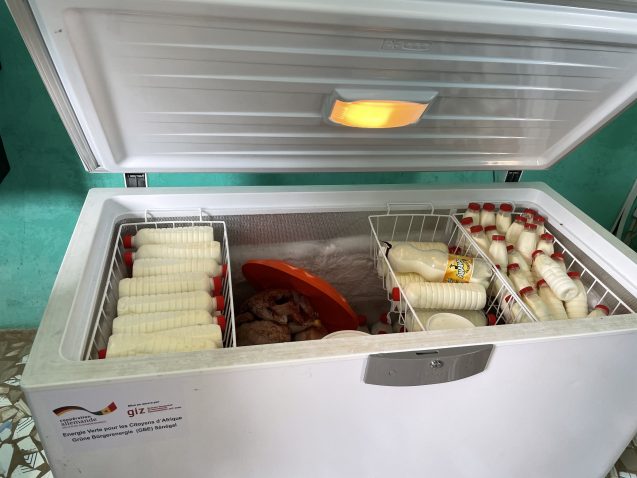

Enter pay-as-you-go (PAYG) as a viable option for making credit readily and quickly available. PAYG essentially addresses the financing challenge by providing a supplier credit, making procurement of renewable energy appliances easy and affordable for customers in rural areas. Normally applied to purchasing components for the solar home system, Green People’s Energy is supporting the PAYG model for renewable energy-based farming equipment, in particular solar-powered water pumps and refrigeration.

Easing access to loans

In Côte d’Ivoire and Senegal, the programme has been working on making access to loans easier, closely working with solar companies and micro financing institutions. In both countries, Green People’s Energy set up results-based financing programmes and offered financial incentives to solar tech companies interested in providing financing for customers with PAYG as the settlement process. The core idea of the RBF programme is to provide financial incentives to companies, to sell solar-powered water pumps or refrigeration units specifically to commercial customers in rural areas without access to reliable or clean energy.

Working with local companies

In Côte d’Ivoire, the programme worked with Baobab+, a social business, and Greeno, a joint venture by EDF and SunCulture). Baobab+ and Greeno sell solar-powered equipment embedded with smart metres and remote switches, allowing these companies to offer a PAYG model for purchase. Greeno, for example supplies solar pumps specifically designed to meet the water needs of the vast majority of small-scale farmers. It offers payment facilities over a duration of 24 months, letting farmers use products while paying for them in instalments. In Côte d’Ivoire, GBE and Greeno agreed on a contract to sell 220 solar pumps as part of the RBF programme. The first rounds of sales of subsidized solar devices to agri-entrepreneurs began in May 2022, as part of the programme’s partnership with the two companies. In Senegal, the programme worked with three local companies, Satech, Solene and Sen Technologie Power. Working both in the north and south of Senegal, the three specialize in distributing solar pumps, and partnered with microfinance institutions to manage loan repayment.

Duplicating the approach

The approach has shown promising results. For Green People’s Energy, disbursing donor funding through its results-based financing system has meant less administrative effort with mobile integration of obligations for payers. In Côte d’Ivoire, 121 solar-powered refrigerators and 35 solar water pumps were sold within almost 13 months. In Senegal, coverage and access to credits for customers in rural areas has proven successful. Disbursing almost €200,000 in PAYG loans, the three companies managed to sell 40 pumps and services to a total 50 smallholders. Farmers can make the payments via their mobile phones and keep track of their instalments. The approach has yielded significant sustainability effects, with traders now starting to duplicate the model.